Weekly Offertory Giving

To manage your weekly offertory contribution through Our Sunday Visitor or to make another payment for a registration or fee, please click below.

You will have the option of creating an account or making a one-time payment.

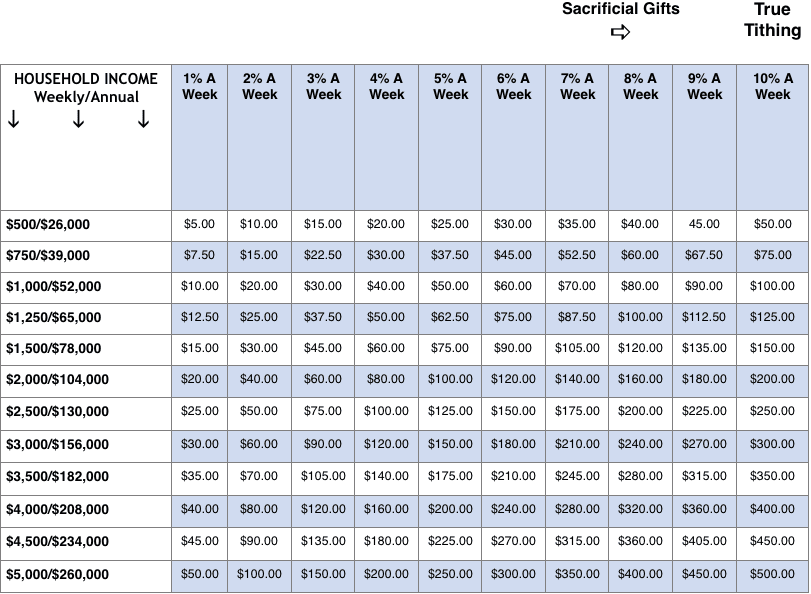

How much should I be giving?

Other Ways to Give

Your gift to St. Catharine of Siena will have an immediate impact on the parish’s many ministries. Gifts can be one-time or set up as an online recurring pledge paid over the course of the year. Your gift to St. Catharine is 100% tax deductible to the fullest extent of the law, so please consult with your tax advisor since tax laws are always changing.

For additional information, contact our Parish Development Office at (614) 231-4509 or by email at bsisson@stcatharine.com

Letter of Bequest

As we demonstrate our devotion to God, we are reminded to be eternal stewards of our faith. By providing a gift to St. Catharine Parish through your will, you leave a sign of your commitment to continue God’s work that was started here in Eastmoor and Bexley in 1931.

"For God's Glory" - Capital Campaign

Be a part of St. Catharine's biggest expansion project since our founding in 1931!

This project has expanded and improved our facilities at St. Catharine; including the creation of a new uplifting Adoration Chapel; a new Parish Center with reception/meeting spaces, kitchen and storage areas; a new Prayer Garden; additional classrooms for St. Catharine School and a new Preschool in the renovated former convent building.

And though this project is complete, please consider your role by supporting this campaign and making a contribution For God’s Glory!

Make a New Pledge or a Pledge Extension below by downloading the appropriate form.

Ministry Specific Funds

Donors can designate their gift to support any number of our Parish’s 20+ ministries which rely on sponsorship gifts. Ministering to the Poor/Hungry; Tuition Assistance Fund for Parish Families in Need; Bereavement Program; Youth Ministry; Respect Life; Elderly & Shut-Ins; R.C.I.A., Alpha, etc.

Pledges can be designated weekly, monthly, or semiannually.

Donors can specify one or more of these ministries by going to: https://www.osvonlinegiving.com/3112

Church Endowment Fund

A St. Catharine Parish Endowment Fund was established many years ago at The Catholic Foundation of the Diocese of Columbus. The Fund provides perpetual funding for the needs of our parish.

Create Your Own Named Endowment

Parishioners can create their own named endowment during their lifetime to provide St. Catharine Parish with a permanent source of income expressly for the benefit of any number of Parish ministries. All endowment funds are established at The Catholic Foundation of the Diocese of Columbus, whose staff will work with you and our Pastor to establish an endowment agreement and awards criteria.

For example, the typical “annual payout” of an endowment is equal to 5% of the fund’s principal balance, i.e., a $25,000 fund balance would provide an annual cash award of $1,250.00 to St. Catharine Church.

For a sample Endowment Description that benefits St. Catharine Church, please contact Beth Sisson: bsisson@stcatharine.com

Stock and Other Appreciated Securities

A gift of appreciated stock (typically held for longer than one year) is an ideal and tax-wise method of supporting St. Catharine Church. As an added benefit to the donor, gifts of appreciated stock avoid any capital gains on the increased value of the appreciated property, and donors receive a full deduction for the full market value at the time of the gift and capital gains tax is not due when the stock is transferred to the Parish. The mean market value on the date of the transfer will determine the value of the gift for tax purposes.

It is best to consult with a financial advisor to ease this kind of gift and to ensure proper credit is extended to you, the donor.

Please contact our Development Office at (614) 231-4509 or download our Stock Transfer Instructions below.

Making a Gift With Your IRA

Parishioners and friends of St. Catharine who are age 70 ½ or older are permitted by law to transfer up to $100,000 from a traditional or Roth IRA to a qualified charity, which includes our church and school! Donors may transfer 100% or a portion of their Required Minimum Distribution (RMD) to St. Catharine Church or School. By electing to gift your RMD to St. Catharine, you as the donor avoid claiming the required distribution on your annual taxes and will benefit even if you do not itemize. Transfers must be made directly from an IRA custodian to St. Catharine so please consult with your financial-advisory team for assistance.

If you would like to support us through your IRA, please contact our Parish Development Office at 614-231-4509 for additional details.